2024/06/05

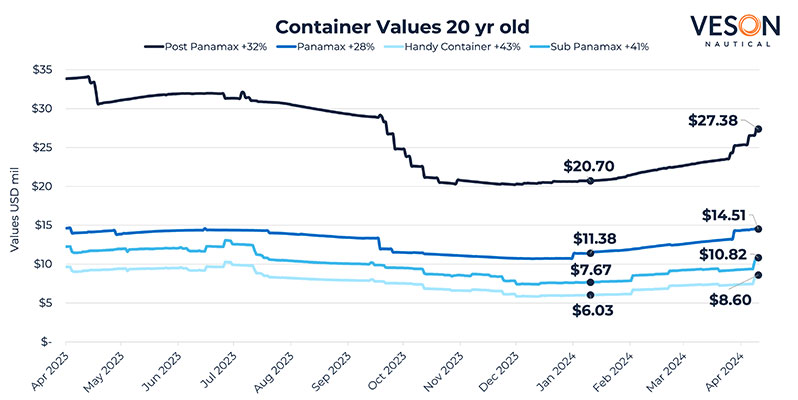

It seems like there has been a notable shift in container values since the beginning of the year, with increases observed across various sectors and age categories. After a period of decline following a peak during the Container boom in Q1 2022, values have rebounded, particularly for older vessels. For instance, 20-year-old Handy Containers of 1,750 TEU have seen a substantial increase of 43%, rising from US$6.99 million to US$8.6 million since January 2024. This resurgence suggests a turnaround in the market dynamics, possibly influenced by changing demand-supply dynamics or other market factors.

The increase in container values seems to be supported by rising earnings since the beginning of the year, particularly evident in the Handysize sector where one-year earnings have surged by approximately 39.4%, from US$9,280 per day on January 1st, 2024, to US$12,940 per day today. This uptick in earnings can largely be attributed to the ongoing disruption in the Red Sea. With vessels rerouting around the Cape of Good Hope due to this disruption, they are traveling longer distances, which in turn reduces available vessels and drives up rates.

According to VesselsValue trade data, container journeys transiting around the Cape of Good Hope have increased by nearly 200% in Q1 2024 compared to Q1 2023. However, despite the ongoing conflict and its impact on shipping routes, the latest forecast from Veson's Market Outlook predicts that as more container new buildings enter the market, vessel supply will continue to surpass demand. This imbalance is expected to put pressure on rates in the future.

MSC appears to be maintaining an aggressive stance in the container market, continuing their container buying spree that has been ongoing for the past few years. They account for almost a quarter of all container sales reported so far this year. Notable benchmark sales include the Post Panamaxes Buxcoast (6,892 TEU, August 2001, Daewoo) and Buxcliff (6,892 TEU, June 2001, Daewoo), each sold for US$22.5 million in an en bloc deal, with VesselsValue valuing them at US$20.01 million and US$19.95 million, respectively. Additionally, in March, the sub-Panamax Odysseus (2,824 TEU, 2006, Hyundai Mipo) was sold to MSC for US$15.9 million, with VesselsValue valuing it at US$13.61 million.