2024/10/17

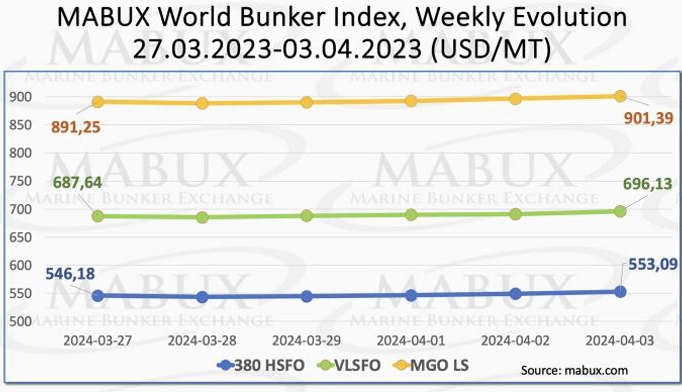

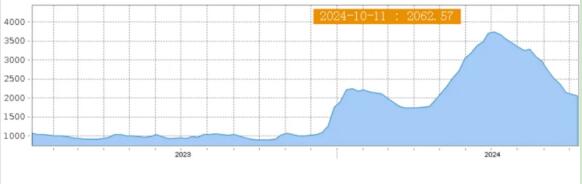

The strike at the U.S. East Coast ports has officially concluded. Despite initial expectations from shipping companies that the strike might lead to increased freight rates and additional charges, these anticipated effects did not materialize. On October 11, the Shanghai Shipping Exchange reported the Shanghai Export Containerized Freight Index at 2062.57 points, a 3.4% decrease from the previous period. Freight rates on the four major routes between Europe and the U.S. continued to decline, with the European route experiencing the most significant drop.

Shanghai Export Containerized Freight Index

The report indicates that the Asia-Europe shipping market has remained weak recently, with spot market booking prices continuing to fall this week. The Mediterranean route mirrored the European route’s trend, with market freight rates continuing to decline. On October 11, the market freight rates (including sea freight and surcharges) from Shanghai Port to basic ports in Europe and the Mediterranean were $2369/TEU, respectively, down 9.3% and 6.8% from the previous period.

On the North American routes, dockworkers on the U.S. East Coast staged a brief strike in early October, which has now been resolved without significantly impacting the shipping market. This week, post-National Day holiday transportation demand recovered slowly, with an unfavorable supply-demand balance leading to continued declines in market freight rates. On October 11, the market freight rates (including sea freight and surcharges) from Shanghai Port to basic ports on the U.S. West Coast and East Coast were $5554/FEU, respectively, down 2.5% and 1.3% from the previous period.

Additionally, the Drewry World Container Index (WCI) shows that spot freight rates from Shanghai to New York fell 3% week-on-week to $5019 per 40-foot container.

Although the strike did not significantly impact freight rates, the three-day strike caused severe congestion, with approximately 70 ships waiting for berths. Last week, 29 ships at the Port of New York experienced delays of up to 39 hours, 13 ships at the Port of Charleston were delayed by 57 hours, and 27 ships at the Port of Savannah faced delays of 70 hours.

With demand weakening, shipping companies have begun increasing the number of blank sailings on major East-West routes to prevent further congestion on the U.S. East Coast. Drewry’s data indicates that from October 14 to November 17, 2024, 69 sailings have been canceled on major East-West routes—Trans-Pacific, Trans-Atlantic, and Asia-North Europe and Mediterranean routes—accounting for 10% of the planned 693 sailings. Of these, approximately 58% will be on the eastbound Trans-Pacific route, 26% on the Asia-North Europe and Mediterranean routes, and 16% on the westbound Trans-Atlantic route.

Drewry also noted that with the strike’s end and the peak demand period waning, despite strong price support from shipping companies, freight rates are expected to continue declining during the current seasonal lull. Freightos Chief Analyst Judah Levine echoed this sentiment, stating, “With the strike over and peak season demand largely behind us, container prices should continue to ease during the seasonal freight lull between peak season and the Lunar New Year.”