2024/05/19

The dynamic currents of economic activity are mirrored in the evolution of the ports industry, where terminals in burgeoning economies are ascending the ranks as regional ports assume greater significance.

In the latest rendition of Alphaliner's prestigious annual compilation of top 30 ports, Dubai has usurped Rotterdam's position in the top echelons, a shift more attributable to Rotterdam's dwindling volumes than to Dubai's expansion. Concurrently, Tanger Med has surpassed Hamburg in the rankings.

Unsurprisingly, six of the top ten ports hail from China, while the remaining quartet comprises Singapore, Busan, the Los Angeles/Long Beach conglomerate, and Dubai in the tenth spot. Noteworthy is Hong Kong's silent retreat from the rankings, once the world's bustling container port, now quietly fading with an average annual volume decline of 10% over the past half-decade.

Projections suggest a continued sluggishness in global economic growth, as evidenced by the World Trade Organization's (WTO) report indicating a steeper-than-anticipated 1.2% decline in world merchandise trade last year. However, a glimmer of hope emerges with forecasts predicting increments of 2.6% and 3.3% in 2024 and 2025, respectively.

Much of the economic downturn in Europe and the US can be attributed to geopolitical tensions in Ukraine, the Middle East, and the escalating rift between China and the US. Nevertheless, the regional ascent of Asian economies persists, with ports in the Middle East, India, and the Far East demonstrating robust growth.

Eleanor Hadland, senior analyst specializing in ports and terminals at Drewry Shipping Consultants, elucidates, "In 2023, we witnessed a broad spectrum of performance across regional markets. Despite the steep decline in North American volumes (albeit in the context of sharp upsurges in 2021/22), Asian markets remained comparatively resilient."

Major US ports have experienced setbacks, with Los Angeles and Long Beach registering a combined 12.6% decline, and New York and New Jersey witnessing a staggering year-on-year fall of 17.7%, exacerbated by significant reductions in Panama Canal water levels.

Trade in consumer hubs has faltered, though this may not signify a permanent state of affairs. Hadland emphasizes, "There have been significant efforts to enhance trading relationships among Asian nations—lowering tariffs and dismantling other trade barriers. Additionally, the diversification of manufacturing beyond China has spurred intra-Asian flows within regional supply chains. Increased consumer purchasing power from these markets plays a role, albeit not the sole one."

Long-term macroeconomic growth is anticipated to emanate from the Middle East, Asia, Latin America, and subsequently Africa, according to former transport analyst Mark McVicar. He contends, "The US economy remains robust, with elevated employment levels and a 2.4% growth rate showcasing its resilience."

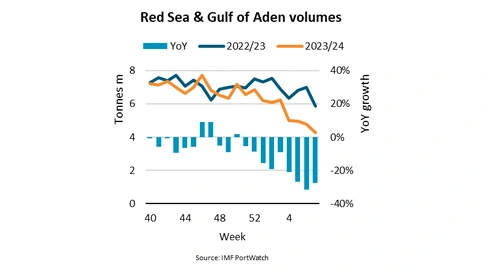

European economies weathered several upheavals, with Russian sanctions impacting throughput from the onset of the Ukraine crisis, while the Red Sea crisis has inflicted damage on Mediterranean ports, particularly in the Eastern Mediterranean.

This upheaval propelled Dubai to surpass Rotterdam in the rankings, ascending to the tenth position, propelled by modest growth of 3.6%, while Rotterdam's volumes plummeted by 9% compared to 2019. Hamburg, heavily reliant on Russian trade, witnessed a throughput decline exceeding 16% during the same period, whereas Antwerp-Bruges remained relatively stable, largely due to the merger of the two Belgian facilities in 2022.

Hadland observes that Northern Europe is in the throes of recovery, citing "challenging macroeconomic conditions, with soaring inflation affecting both the European manufacturing sector and consumer demand."

She notes that the repercussions of the loss of Russian transshipment volumes were still palpable in Q1 2023. However, Drewry's rolling 12-month average growth rate exhibited signs of improvement, reaching -1.2% in February 2024, with further amelioration projected for March.

This trend was underscored in Q1 2024 figures, with Rotterdam reporting a 2% increase to 3.3 million TEUs, and the Port of Antwerp-Bruges registering a 6% surge to 3.28 million TEUs compared to the corresponding period in 2023.

In the interim, the Gemini Cooperation, an alliance between Maersk and Hapag-Lloyd, employing a hub-and-spoke system, might prompt a shift in cargo distribution toward regional ports. Stefan Verberckmoes, an analyst at Alphaliner, remarks, "It is indeed remarkable to observe that Tanger Med has already surpassed Hamburg as a container port."

He further elucidates, "Several leading carriers have invested in Tanger Med, recognizing its strategic position as a pivotal hub connecting East-West and North-South services. This month, we witnessed yet another instance of adjustments in routes, such as the EURAF 5 service of CMA CGM, which has curtailed calls at Antwerp and Le Havre, redirecting through the Gibraltar Strait."

Tanger Med boasts four container terminals and is operated by APM Terminals, Eurogate, and the Tanger Alliance. With 8.61 million TEUs handled last year, it has outstripped Hamburg's 7.74 million TEUs, with the German port witnessing a 16.5% decline in volumes, while its Moroccan counterpart, strategically nestled in the Strait of Gibraltar, has surged by 79.4% since 2019.