2024/06/14

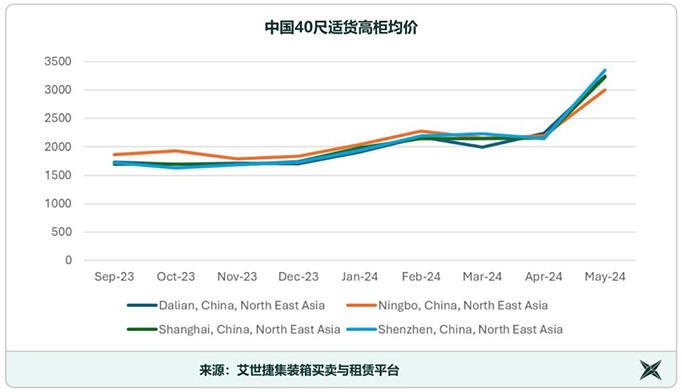

In May, China's container market experienced significant volatility, with container prices rising beyond expectations. The average price for a 40-foot high-cube container at major Chinese ports increased from $2,240 in April to $3,250, a 45% month-over-month rise. In comparison, the market price was only $1,698 last November, while during the pandemic in 2021, it reached approximately $7,178.

(Source: xchange)

Behind the Price Surge: Capacity Shortage and Increased Demand

The recent increase in container prices is driven by a severe shortage of container and vessel capacity, coupled with an unexpected rise in demand. The capacity shortage stems from the Red Sea crisis, which forced ships to reroute via the Cape of Good Hope, stretching carrier networks thin. Shipping companies, striving to maintain weekly sailings, had to deploy more vessels on the Asia-Europe routes, complicating incident management.

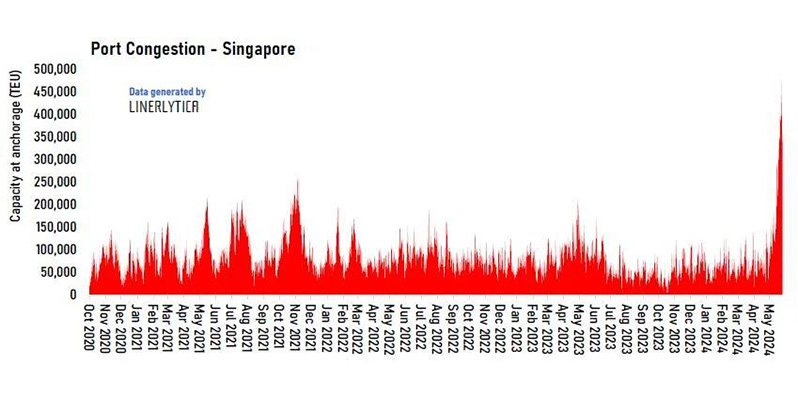

Additionally, rerouting via the Cape of Good Hope and the subsequent "rebalancing" of capacity networks caused downstream disruptions, such as port congestion. These temporary network changes and the clustering of vessels overwhelmed some ports, similar to how increased traffic leads to highway congestion.

The Number of Backlogged Containers at Singapore Port

(Source:Linerlytica)

Furthermore, to avoid potential issues in the latter half of the year, shippers opted to advance their shipments, leading to an unexpected surge in capacity demand.

Short-Term Price Bubble

It is evident that the current spike in container prices is unlikely to be sustained long-term, as it lacks robust demand support. Concerns about the labor market and high interest rates suggest that consumers may reduce spending, decreasing the demand for goods. Consequently, freight volumes are expected to decline in the short term, unless there is a strong recovery in demand and a swift depletion of supply.