2024/04/09

In the wake of the Baltimore Bridge calamity, those entrenched in the intricacies of supply chain management foresee impending escalations in costs, as evidenced by a marked uptick in the anticipation of container price surges.

A resurgence in freight volumes entering the United States this annum, in tandem with the bridge debacle and persistent hurdles in both the Red Sea and the Panama Canal, is poised to exert pressure on pivotal American ports in the near term. Such conditions are anticipated to engender heightened congestion, further logistical and operational entanglements, and price augmentations in both the immediate and medium-term future.

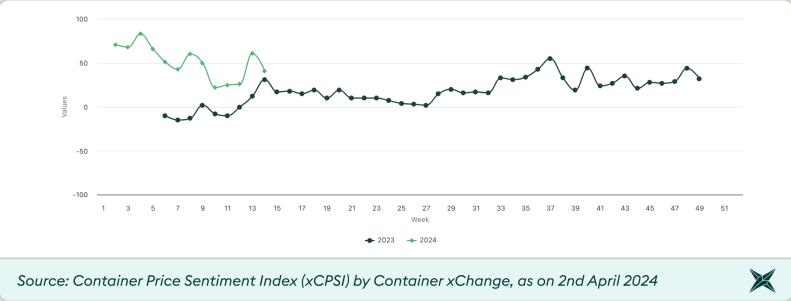

The Container xChange’s Container Price Sentiment Index (xCPSI) experienced an unforeseen leap from 26 to 61 points between March 18, 2024, and March 29, 2024. This significant elevation intimates that the sector is bracing for a forthcoming uptick in container costs—while the abruptness of the index’s fluctuation underscores a burgeoning uncertainty within the marketplace.

“The pronounced escalation in sentiment might be attributed to the prevailing market fluctuations, the acute crisis unfolding on the US East Coast in the aftermath of the Baltimore mishap, and the consequent protracted strain on the market,” remarked Christian Roeloffs, co-founder and CEO of Container xChange.

Feedback from industry insiders has signaled an expected surge in container prices in the imminent days or weeks, with estimates ranging between 50 to 100 US dollars per TEU. This intelligence implies that clients in the market for new build units might face elevated prices in comparison to the preceding weeks. A manufacturer, previously cited in our reports, confidentially conveyed this perspective.

Moreover, another client from Europe, opting for anonymity, is amassing an assortment of units in anticipation of forthcoming price escalations. Drawing from these observations, it seems the market is on the cusp of experiencing price increments in the near future.

Update on the Baltimore Incident

As of March 29, 2024, the Key Bridge Response 2024 Unified Command disclosed that out of the total containers aboard the vessel, 56 harbored hazardous materials, with 14 being directly affected. These 14 containers underwent evaluation by an industrial hygienist to ascertain potential risks. The Unified Command alongside the Joint Information Center was inaugurated in Baltimore on March 26, 2024, to orchestrate the response efforts and circulate updates concerning the collapse of the Francis Scott Key Bridge.

Subsequently, the Captain of the Port (COTP) Baltimore has delineated a provisional alternate passage on the northeast flank of the principal channel near the Francis Scott Key Bridge, as announced by Mayor Brandon M. Scott on Sunday, March 31, 2024.

This interim passage will be demarcated with government-operated navigational aids and will feature a controlling depth of 11 feet, a horizontal clearance of 264 feet, and a vertical clearance of 96 feet. Efforts are underway by the Unified Command to inaugurate a second, provisional alternate route on the southwest side of the main channel. This additional route is designed to accommodate vessels with deeper drafts, projecting a draft limitation of 15 to 16 feet.

Container vessels are necessitated to recalibrate their navigation to avail themselves of this provisional channel, which is distinctly outlined and marked to guarantee a secure transit. This interim measure aims to sustain the continuity of operations for commercially vital vessels, including container ships, mitigating the disruptions caused by the bridge’s downfall. Shippers are advised to prepare for cost surges and increased logistical demands.

Moreover, shippers whose itineraries encompass Baltimore are poised to encounter formidable obstacles shortly. A primary concern is the escalation in shipping costs and ancillary expenses attributed to detours, anticipated to inflate. Furthermore, the onus of retrieving cargo from alternative ports now falls on the shippers, as communicated by MSC and various other maritime carriers. This adjustment necessitates shippers to engage meticulously with freight forwarders, trucking entities, and additional logistics partners to assure the secure and efficient conveyance of cargo to its intended destination.

"In the immediate future, the bridge’s demise is expected to precipitate localized disturbances in container accessibility and transport. The incident has further prolonged delivery durations and augmented fuel expenditures, which could, in turn, indirectly influence container pricing and leasing tariffs in the forthcoming period,” Roeloffs elaborated.